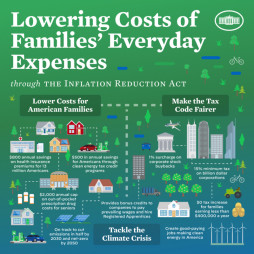

Inflation Reduction Act Resource Hub

The Inflation Reduction Act, passed by Congress and signed into law by President Biden in 2022, provides tax credits to help households reduce their energy costs and transition to clean energy technologies. There are similar grants and tax credits available for non-profits and businesses to save money and invest in clean energy.

The County's partners at Power a Clean Future Ohio have compiled resource hubs to help our residents, non-profits and businesses navigate the benefits of the Inflation Reduction Act.

Resources for Summit County Residents

Residents purchasing new windows, doors, solar panels, heat pumps, electric vehicles and other energy-efficient products may be eligible for federal tax credits. Visit PCFO's Resident Resource Hub to learn more.

Resources for Summit County Businesses

The Inflation Reduction Act gives businesses an incredible opportunity to make long-term investments in clean energy. Visit PCFO's Business Resource Hub to learn more.

Resources for Summit County Community Organizations

Non-profits and other community organizations can access tax credits for electric vehicles, green infrastructure and more. Visit PCFO's Community Organization Resource Hub to learn more.